-

Services

The case for a global IT service desk

The help desk function typically makes up less than five percent of a firm’s IT spending, but can represent almost 50% of the IT organization’s perceived value.

Revolutionizing Field Service Management

The AVASO Field Force Application (FFA) is your ultimate partner for efficient, seamless, and innovative field service management.

SD-WAN – in the cloud

WAN enables telecommuting and cloud applications; SD-WAN simplifies complex connections. Upgrade your system today?

Mixed reality applications for office communication

Since last year, workers adapted to mixed reality tools, merging real and virtual worlds for collaboration.

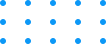

Why endpoint management should be top priority

AVASO's Integration Center services offer a risk-free alternative to onsite implementation.

IT Asset Disposition Services

Organizations rely on technology, but outdated systems become liabilities when support costs surpass their performance.

Cyber Security risks

Around 85% of CISOs admit remote work led to cybersecurity sacrifices; address security gaps now.

Yes, you can support remote workers while securing the cloud

It’s a seeming dilemma: how do you support your remote workforce while keeping the cloud secure? Tech Observer digs into the question.

What to include in your security policy for mobile devices

Smartphones and tablets are great tools for productivity in the workforce.

Top 5 reasons to work with a managed services provider

Is this the year that green technology becomes the norm? As you study trends and discussions about tech’s impact on the world, it certainly seems that way.

-

Careers

The indispensable nature of technology

Interdependence — it was true before and it’s true now. #technology #techadvancements

Three reasons to hire local field engineers

When it comes to project deployment, you can choose to send your own technicians to the site, or you can hire local field technicians who already have a presence in the area.

Our company values

When partnering with AVASO Technology Solutions, we meet client IT needs with Respect, Integrity, Responsibility, and Teamwork at our core.

Culture in the business world

How do cultural and communication differences affect global business success? An article by The University of Notre Dame from October 8, 2020, examines this question.

-

Company

CMMI SVC Level 3

The Capability Maturity Model Integration (CMMI) is a globally recognized framework that enhances process efficiency, quality, and performance

Evertreen for Global Reforestation

In partnership with Evertreen, we contribute to global reforestation efforts by planting real trees through their innovative online platform.

EcoVadis Sustainability Assessment

EcoVadis is a trusted global provider of business sustainability ratings, evaluating companies based on their environmental, social, and ethical impact.

Sustainability in Tech Business

Sustainability is indeed something that isn’t as tangible as it seems. As it’s still evolving alongside innovation, it can be hard to quantify and measure success.

Digital Workplace

- Device as a Service (Daas)

- Smart Lockers and Vending Machines

- HW Maintenance & Support Services

- IT Field Technical Services

- Centralized Walk-Up Centres

Cloud & Application Services

Depot & Logistics Services

- Asset Warehousing & Configuration Management

- Importer/Exporter of Record (IOR/EOR)

- Asset Roll Out and Lifecycle Management

Strategic Staffing and Payroll Services

Consulting & Professional Services

Service Desk

Enterprise Services

- Managed Network

- Smart Data Storage and Recovery

- Liquid Cooling

- Data Center Relocation & Migration

- Structured Cabling